"The International Jew" Study Hour - Episode 63

Sept. 5, 2013

Carolyn Yeager and Hadding Scott read and comment on Chapter 58, “Jewish Idea Molded Federal Reserve Plan.”

We are reminded that Paul M. Warburg was “an alien not naturalized” when he secretly closeted with Senator Nelson W. Aldrich and other bankers on Jekyll Island to formulate a Central Bank for the United States in 1910. Warburg became a U.S. citizen in 1911. In 1914, he was still a partner in the German banking house of M.M. Warburg, Hamburg, Germany, while a member of the U.S. Federal Reserve Board as this country was preparing to go to war in Europe. Other interesting facts:

- A real Central Bank was considered only one bank, but we were given 12 regional banks along with the New York bank only to placate the public’s fears about the whole scheme;

- It is part of Jewish policy – and large financial firms – to attach themselves to both (or all) political parties;

- The various principals of Kuhn, Loeb & Company contributed to Wilson, Taft and Roosevelt in the Presidential race of 1912 – when Wilson won, a member of the firm received an important appointment giving him large power over the finances of the U.S.;

- One of the functions of the Federal Reserve Board is to guard the gold supply of the country, yet Jews who were associated with foreign banks sat on the Board.

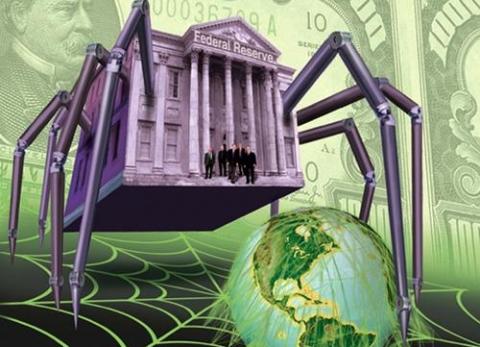

Image: A Dees illustration portraying the Federal Reserve as a giant spider capturing the world in it’s web.

Note: We are using the Noontide Press publication of The International Jew — The World’s Foremost Problem which can be found online here as a pdf file.

Category

International Jew Study podcast, Jews- 674 reads

Comments

Original comments on this program

2 Responses

Steven

September 6, 2013 at 7:47 am

•One of the functions of the Federal Reserve Board is to guard the gold supply of the country, yet Jews who were associated with foreign banks sat on the Board.

Carolyn if the Federal Reserve has committed to guard the gold supply of the United States, other countries and wealthy individuals then it should be available for repatriation any time the owners show up to take delivery.

If this were the case Germany would not have to wait 7 years to take delivery of their holdings. This points to fractional reserve gold and silver lending by banks in general. If you are lending an asset that has infinite supply that does not present a supply problem but if you lend out an asset that is being held for safe keeping and is in limited supply then that is a problem if not a crime against the true owners of the asset.

Nations and investors should rethink the wisdom of entrusting their gold and silver to jewish banks and banks in general for safe keeping and act on that basis.

Carolyn

September 6, 2013 at 1:20 pm

I’m very sorry that I kept referring to the M.M.Warburg bank in Hamburg as a “law firm.” I couldn’t believe my ears, listening to the show, that I just kept repeating it. Hadding did not correct me, either. But he did correct me on some other mispeak, for which I was grateful.

Anyway, Paul Warburg was not associated with any law firms or partners, but only with banking houses and bankers, both in Germany and in New York.

Also, Samuel Jones Lloyd, mentioned as “virtually” responsible for Peel’s Bank Act of 1840, was not a Jew as I thought he must be.